ERVEN PLANNING – The Planning Process

In our busy lives, it can be hard to find the time to give serious thought to, and plan for our financial future. But, the unthinkable can happen and we all need to consider the possible scenarios that may send us in an unplanned direction, and then prepare accordingly. Planning for your financial future can seem overwhelming – but everyone needs to take the time to plan for the unthinkable – both good and bad.

Canadian Life and Health Insurance Association’s Wendy Hope says “When you have liabilities and you have a family, you want to make sure that you provide them with some protection should something happen to you.” Her organization represents the insurance industry in Canada. She says, “Waiting until the ‘unthinkable’ happens to try and plan for an emergency is too late. The time to plan is now.”

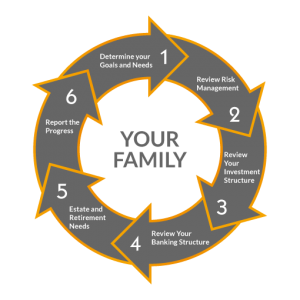

Planning includes thinking about your future and what could happen if your income suddenly stops – you need to start by looking at where you are right now. The diagram below helps you make sure that all your personal circumstances are taken into account, even the things you may not think of, and how at Erven Planning we can help.

STAGE 1: In this stage, we look at your financial goals for retirement, whether your goal is to provide what you need or what you want. We review your family situation and what effect your retirement or income stoppage could have on family members. We also look at the situations that may cause you to lose your income, not just retirement, but any other scenarios that may arise. For instance, what happens if you become disabled? A disability may mean you can no longer work. Your income stops and your new situation may include additional expenses.

STAGE 2: Review Risk Management sounds a little overwhelming, but after we have established your financial goals we then look at the protection you would need to make sure your income continues when you need it most. At this stage, we discuss how to manage the risks identified in stage one.

STAGE 3: After we look at your goals to secure your financial future, and the protection you need to achieve it, the next stage is to look at what securities you currently have. There are many financial products available, but each one is created with a specific goal in mind. Financial products may be designed for a small family or single person or may have been purchased years ago – long before your circumstances changed.

STAGE 4: We review the way the different financial products work and what type of product may be right for you.

STAGE 5: During this important step, we review all the products you currently have and see if their income potential is maximized.

STAGE 6: The last stage of the cycle is to evaluate and review how the products are performing in relation to achieving your goals. Regular evaluations can help assure you that you have the insurance you need.

This may seem a little complicated, but just as you are unique, so are your financial circumstances. It is important to go through each stage to determine exactly how much insurance you need, and what type of insurance is needed. Just as there is no ‘one size fits all’ policy for every person, there is no ‘one policy covers all’. You may need a range of insurance products to balance all the different facets of your life, and they may have to be adjusted at the different stages of your life.

This Personal Planning Process is more about identifying your needs so that you can get exactly the right product for your unique situation, but also about identifying any gaps in your current financial products. Regardless of your current circumstance, you need to consider what happens when your income stops – especially if you have dependants.

“Even though you’re paying for a mortgage or you’re paying for your children’s education, you’ve got all these other outstanding liabilities, you would want to think about the fact that you need – if something should happen to you – to cover those liabilities for your family,” Wendy Hope said.

At Erven Planning, we have the knowledge, expertise, and products to help make your financial journey a success – ask us!